When renting a car in Australia or New Zealand, it is very important to have quality insurance coverage for the vehicle. You have several options available, and by comparing and contrasting the different types of insurance, you can have a better idea of what you might need.

Credit Card

Many times, the credit cards you already have in your wallet will actually have collision coverage included on them. If you choose the right credit card to pay for the rental, you could actually receive coverage with zero deductible, or at least a very low deductible. This is quite different from the high cost of insurance through the car rental companies. The right card has the potential to provide coverage for any of the costs for which you might be liable, such as damage to the car, or even a theft.

There are two issues consumers should keep in mind when using this method of coverage for their rental vehicles.

- Check your credit card’s fine print related to rental car coverage exceptions. Often credit cards only cover the rental company’s standard CDW inclusions. This can mean things like windscreen, tyres, undercarriage and hail damage for example, are not included. As a rule of thumb, if the fine print does not say that these items are included in coverage, then safer to assume they are not, and then consider using a different credit card or another method of coverage.

- Secondly it can be a hassle to deal with the credit card companies in the advent of a claim.

Still, given the amount that you could possibly save in the event of an accident, it does make sense at least to consider utilizing credit card coverage for the rental.

Make sure that your credit card company offers this type of coverage, as some do and some do not. Look through the policies regarding the coverage it offers, and make sure it is applicable in Australia or New Zealand – or any country you might be visiting for that matter.

Standard Travel Insurance Cover

In some cases, you may also have collision coverage available through your travel company. If you buy a travel insurance policy for your vacation through many companies in Australia and New Zealand, you will have the option of adding on insurance for your car rentals. However, it is important to make sure that the amount of excess coverage is high enough (at least $4000) and check the fine print for exclusions. Similar to credit card cover, travel insurance often only covers the rental company’s standard damage and CDW. For example when renting with Thrifty the standard damage does not include windscreen, undercarriage, single vehicle accidents and hail damage. In this case if your travel insurance only covers standard damage, then it won’t be enough to cover these items.

Dedicated Rental Insurance

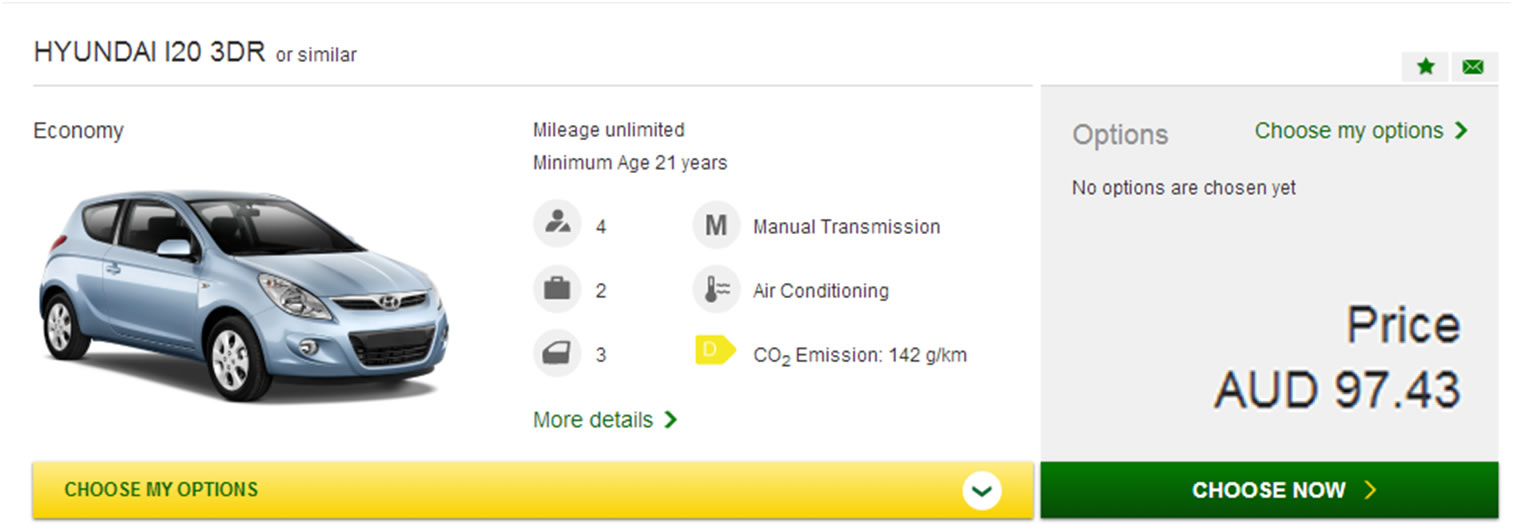

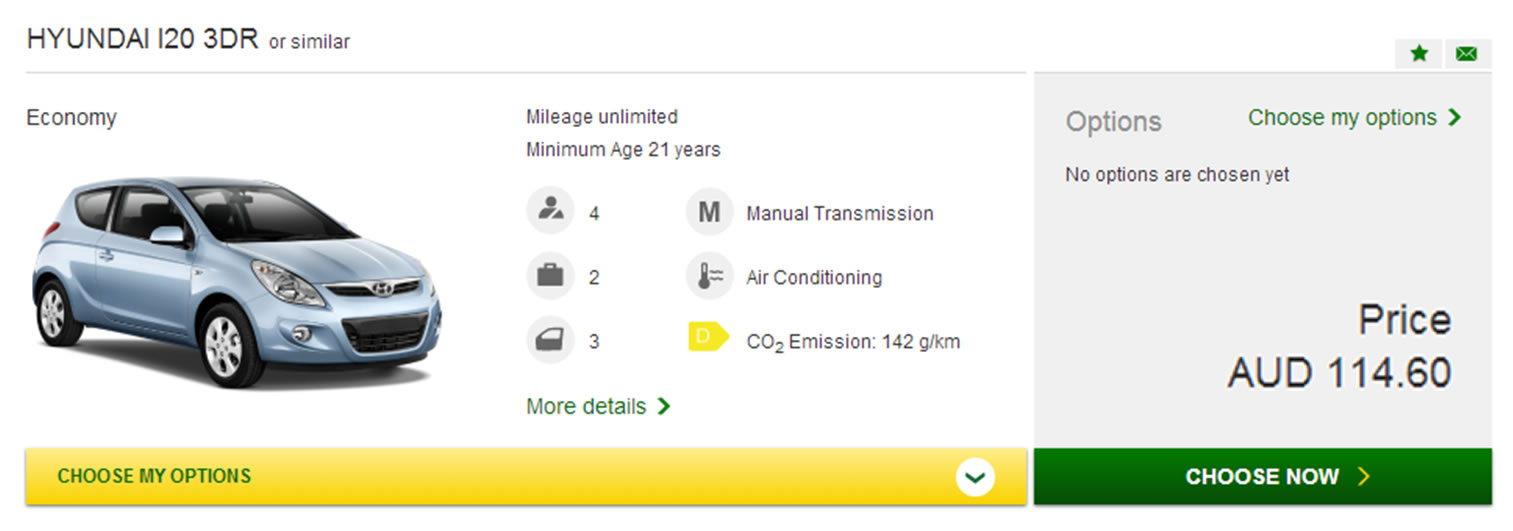

Of course, there’s always the option of buying your rental insurance right through the car rental company. This is something they will actually encourage you to do. It’s a simple solution since you can do it right at the counter. However, that does not necessarily mean it is the best solution. The cost of the insurance through the company is expensive, and could be close to the cost of the rental itself, which could double your overall expenditure. When you buy insurance through the rental company, you should not think that it will automatically cover the entire cost of damage or theft. Look at what you’re deductible or excess will be. It can be in the thousands in many cases and often you need to buy the premium coverage option to be fully covered and reduce your excess to zero.

Dedicated Car Rental Reimbursement Insurance

A newer and lesser known alternative to credit cards, travel insurance and insurance direct with rental companies, is car rental reimbursement insurance. It works very similar to the rental company’s cover, however it costs significantly less, as low as $6.77 per day for a seven day rental, and can be purchased independent of the rental company. This mean that if you damage the rental car, the rental company will still deduct the applicable excess amount from your credit card, however if you have purchased a reimbursement policy, then you receive a refund within 10 days of the claim being made, provided you have driven the car within terms and conditions of the rental contract.

Australia first car rental reimbursement cover provider is Tripcover.com.au, which offers such cover for Australian resident travelling in Australia and around the world, as well as cover to international visitors to Australia. A rental car insurance for New Zealand residents is also available. The products are created and managed in partnership with Allianz Global Assistance.

Now you have real choice

Take the time to research all of your options for your car rental insurance, and then choose the one that makes the best financial and coverage sense for you.