Like us on Facebook and go into the draw to win a 2 day, Audi A3, rental and of course we’ll cover you with zero excess with a TripCover policy. Competition is drawn on April 9, 2013.

The power of patience

The power of patience – Flying Solo Article

By Peter Crocker – In a world that glorifies rapid growth, romanticises rags-to-riches stories and lauds overnight sensations, you’d think that business success hinges on dreaming up the next big idea. Does it really? …..more

My Comment:

After reading the E-myth about 12 years ago Peter, I was inspired to do business a better way. The internet facilitates this type of thinking and can potentially earn us relatively passive income if done correctly. 12 years on, going bankrupt, and losing about 100K, I still grasp onto that belief or hope but understand that it still could be a pipe dream.

I will let you know if I get there with my latest venture TripCover car rental excess insurance, but I agree with you one needs patience, patience and more patience.

Peter’s reply:

Hi Des, I read the e-myth ‘contractors’ version quite a few years ago too and it made a big impression on me. I checked out your new venture too, looks interesting, I liked your proposed advertising images especially 🙂

I wish you patience and all the best with the new venture! Hopefully you’ll fill us in as you progress.

Cheers

New App Beats the Car Rental Trap

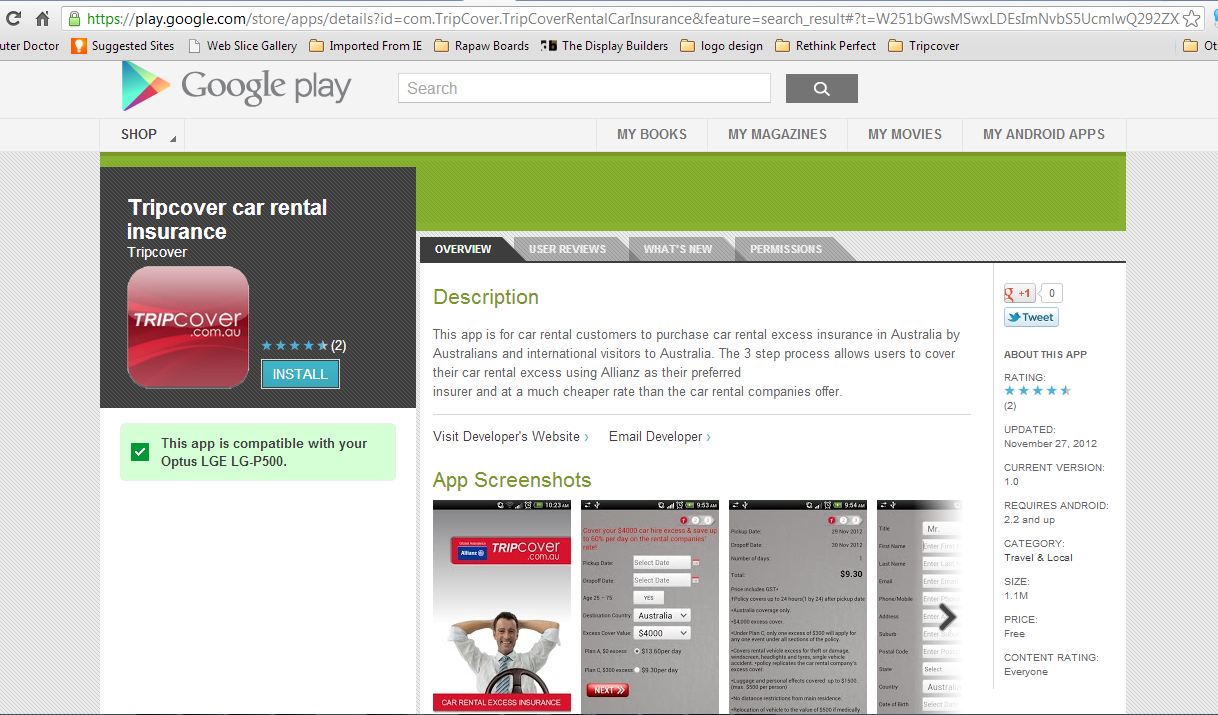

There’s a new app that allows you to beat the car rental giants’ (such as Avis, Hertz, Europcar, etc), expensive car hire insurance trap. Now users of iPhone and Android smart phones can save over 60% in just three taps after you download the App.

You know the drill, you are at the car rental desk and surprise, surprise, the staff ask; “would you like to reduce your $4000 excess by just paying $33 per day?” It’s tempting right, but very expensive! Well what if you could insure that $4000 rental excess from as little as $5.51 per day? (new rates coming by mid January 2013)

Desmond Sherlock , the GM of Tripcover.com.au believes their new App will make it even easier for Australians and overseas visitors to still get the peace-of-mind that excess insurance provides, while on the go and save a bundle. “We’ve been involved in the car rental industry for 15 years and we see this rental trap as the #1 pain point for renters. We’ve designed our car rental excess product in partnership with one of the world’s largest insurance companies, Allianz, to bring it down under”.

Sherlock added, “At present this is the only app of its kind, globally, so, as a small Queensland company it is nice to be ahead of the crowd, for now!”

iPhone and Android apps are Now Available

Yahooo! After much delay our iPhone and Android apps are now available for free download at the iTune and Google Play stores. Simply go to iTunes and Google play sites and search for Tripcover.

Now, when you are at the rental desk you can decide to by-pass the car rental companies expensive excess reduction offer (between $22 to $27) and simply use the Tripcover app to cover your rental, from $9.30 per day, while you are heading to pick up your car.

Thrifty, The Smiling Assassin and Debit Cards

I hired a car today from Thrifty.

Of course I used Tripcover to cover my excess and reduce it to $0 for $13.60 per day.

When I got to the Thrifty rental desk I was told that if I wanted to use my MC debit card that they would need to take the $3300 excess out of my account right now. Otherwise I was going to have to take out their very expensive $27 or $33 excess cover. I told the guy that I did not have $3300 in my account and he simply smiled and said “I knew that, as most people usually don’t”. Ca-Ching!! His eyes lit up with $ $ signs.

I told him that I already had insurance with Tripcover and he smiled again and said his hands are tied. Finally When I told him that I thought that this was outrageous he simply smiled again and said ” I know!”

I think Thrifty should make their policy clear with regards debit cards as the car rental company knows that once we get to the desk we have little or no choice at that point.

PS. When I returned the car I pointed out that their terms and conditions on their website

did not indicate this new policy. I was told that it was so new that it was not on their website. Go figure! I am supposed to know about their new policy by rolling up to their desk and get informed on the spot. I think this is why the ACCC has targeted the car rental industry because of this type of treatment of their customers. Although they were apologetic this time, I will be calling their head office and requesting a refund of my $27 extra insurance that I was forced to purchase, with no mention in their T&C.

PPS: Yeah! I got a response from head office and all is good, I think.

Good afternoon Mr Sherlock and thank you for taking the time to get in touch with us.

As a Blue Chip member no bond is payable from you at any time. There has clearly been an issue with our staff member on front counter misinterpreting an internal directive and I hope that you can accept my apologies for any confusion and any pressure to reduce your damage liability against your wishes. I have today directed our accounts department to refund $27.94 back to your debit card.

Once again, I do apologise for any inconvenience.

Kind regards

Thrify

What the car hire companies don’t want you to know

Do we treat hire cars the same as we treat our own cars? There have long been jokes about the invincibility of rental cars. Like most jokes, they are funny because they are based in reality. For some reason, the urge to drive a hire car slightly more aggressively than you drive your own is something that fills even the most meek driver. Why? Because hey, why not? more

Do we treat hire cars the same as we treat our own cars? There have long been jokes about the invincibility of rental cars. Like most jokes, they are funny because they are based in reality. For some reason, the urge to drive a hire car slightly more aggressively than you drive your own is something that fills even the most meek driver. Why? Because hey, why not? more

Feedback on Tripcover’s Low-Cost Car Rental Excess Insurance

(Generic email I have sent to some car rental companies in Australia)

Hello Sir/Madam,

I know this is a bit left of field and I feel like I am entering into the lion’s den,

but I just thought I would seek out some feedback on our product from a

car rental supplier’s view point, such as yours.

I was thinking, why wouldn’t the suppliers want to finally get on the good side of

their customers and offer them the option of using two excess products.

That is, your premium product and a low cost or budget product?

Low cost, because customers’ credit cards would be charged if they have an accident

and then they would have to make the claim through the insurer direct.

Instead of looking at it like eating into your market you could look at it growing the excess insurance market (from less than 50% to say 75%) by offering the two products and become more endearing to your customers, and regulators to boot .

In the research I have done to date, there is not a car rental customer that I have asked about this issue that does not recognise it as the elephant in the room (or rental desk) .

Some car rental excess insurance customers comments:

Anyway, it seem to me that the winds of change are afoot here, in the context of excess cover, (over the next 5-10 years) We all know what has happened to companies like Kodak, Fairfax, Sony (walkman), blackberry, and a litany of incumbents that failed to see the writing on the wall until it was too late.

We had an article in the Age and SMH Traveller on Tripcover on the weekend just past:

Sherlock Cracks The Case

Anyway, thanks for your time and as usual any feedback would be much appreciated.

(it might be just interesting for us both to have this email on file over the next 5 years to see how close I was, after all it sounds far fetched today but then again that is the nature of change, I reckon)

Kind regards,

Des Sherlock

General Manager

|

| CAR RENTAL EXCESS INSURANCE Managed by Allianz Global Assistance Suite 243, 1B 192 Ann Street 0417 712 601 |

Customer Comments:

Here are some of the comments from our latest customer survey, when asked about the high car rental company rates on reducing the excess:

“Great to see a product that’s been overseas come here. I think the excesses rental car companies charge are ridiculous and are just part of getting you to pay them more for the hire”

Suzanne N.

Sherlock Cracks the Case

Smart Traveller article from The Age and the Sydney Morning Herald on Tripcover

July 7, 2012

Sherlock Cracks the Case

Desmond Sherlock is a thorn in the side of Australian car-rental companies. About six months ago, he started tripcover.com.au, the first insurer to specialise in car-rental excess insurance.

“Our premiums are about a third cheaper than what you get with the rental companies,” Sherlock says. “Their insurance rates are usually from $22 to $27 a day to reduce the excess to $300. Our rates start at $9.30 a day.”

Sherlock says that some car-rental policies have excesses up to $6000. Of 6.8 million annual car rentals in Australia, between 30 per cent and 40 per cent of people opt to buy excess reduction.

He agrees many travel-insurance policies also provide car rental excess reduction, but claims his company (managed by Allianz Global Assistance) is the only specialist in Australia and soon hopes to offer an annual policy and expand to New Zealand.

Some Complaints from Car Renters

Car renters struggle to give up old tricks

What is it about the car hire industry that makes it a candidate for the most poorly behaved corporate sector in Australia?

Over a decade or more up until the middle of last year, it seemed to me the car renting business had become virtually incapable of telling the truth about the real cost of renting a car.

The headline rate that appeared in advertisements was usually about half what you’d be up for when you added all the asterisked charges, then put petrol in the tank. Heaven help you if you took the car back with a tank that needed topping up at the renter’s sky-high prices

Read more: October 4, 2010

Comments

· I booked a car online for one day in Sydney for a fleeting day trip to be at a special occasion for an old friend. The email receipt I received for my reservation mentioned an additional fee for ‘excess reduction’ on top of what I’d already paid for excess cover, but did not mention what the excess would be if I did not pay the fee. I found out when I arrived to pick up the car that it was a whopping $3500 excess which I think is a risk few people would be willing to wear. So in fact my rental for the day was $30 more than I was quoted PLUS an additional airport fee of $18 which was also not mentioned along with the “airport concession fee recovery” of $11 quoted in the receipt. No way would I have rented a car for the day if I’d known how expensive it would be.

Commenter

BelaS

Melbourne

October 04, 2010, 10:46AM

Read the contract. Be aware of your responsibilities. Ignore the super deals advertised and negotiate the full price at the counter. Use your phone/camera take photos of vehicle before you leave for damage reference. Would you lend your brand new car to a complete stranger without any conditions for $50 a day?? No, so cover your arse and read the fine print.

Commenter

Barney Melb

October 04, 2010, 10:47AM

If you have insurance, you shouldn’t have to worry too much about excessive charges for damage. Take a video camera and do a once-over of the car to identify any marks and report any that aren’t on the paperwork before you leave the car park. Other than that, there isn’t too much that can go wrong. If you forget to fill up before returning the car, it’s hard to blame the rental company. The fuel gauge will indicate full for a while after you fill up.

- Commenter

- jules

- Location

- melbourne

- Date and time

- October 04, 2010, 10:52AM