Confusion Reigns

I was speaking with J. Bird on the phone the other day about excess cover and the car rental companies generally and he came up with this quote that I agreed with and hopefully, with a bit of help from Allianz Global Assistance Australia we can overcome it.

.

.

.

“If someone had set out to design a business system that would piss people off they could not have done a better job than what the car rental companies have come up with”

J. Bird

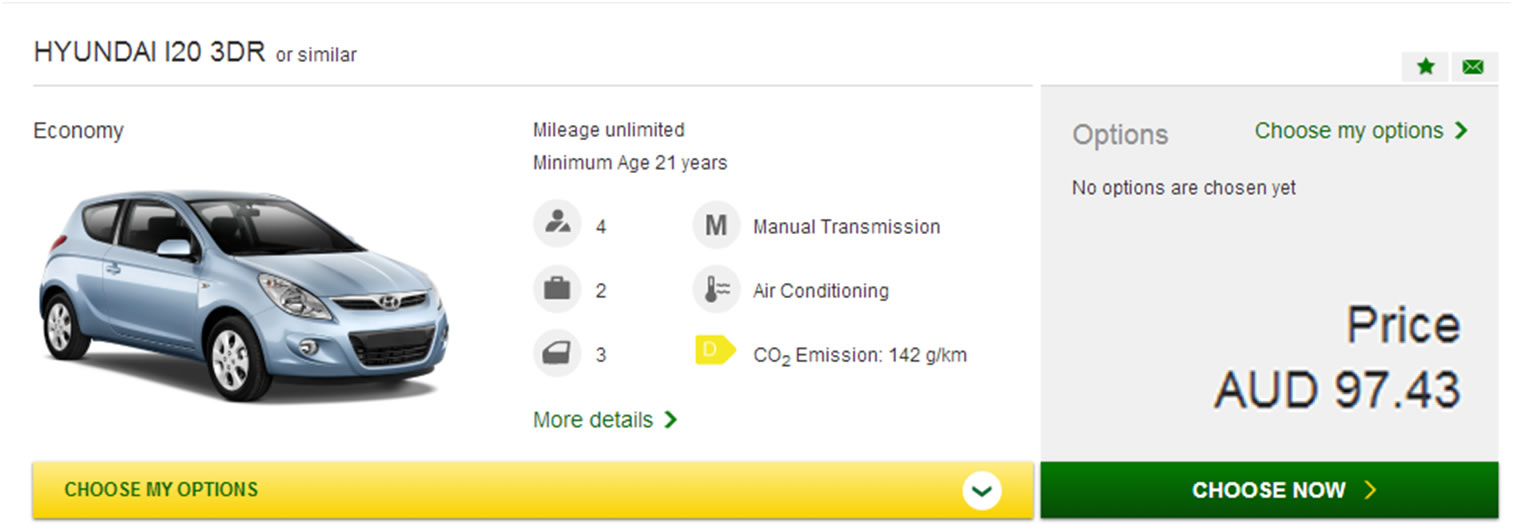

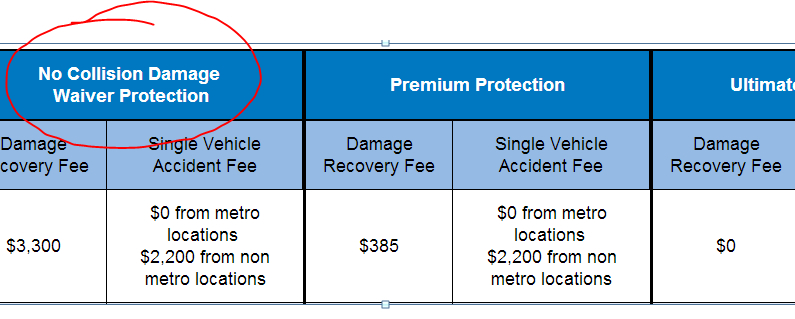

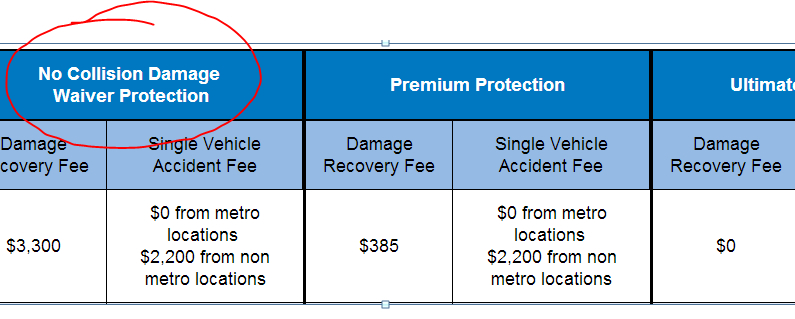

Time for a change I reckon. I have been working in this business of car rental excess insurance (deductible or CDW) for two years now and am still trying to get my head around what the car rental companies cover and don’t cover as part of their $3300.

For example Thrifty Australia have an excess of $3300 but on top of that they have

a single vehicle accident (SVA) of $2200 if you take a rental from their non-metro depots. So does that mean that their excess is $5500 and not $3300 in this case??

There are some 6 major car rental companies (on Australian airports) and each one have idiosyncratic clauses in their rental agreements and terms & conditions that totally leave their customers flabbergasted and confused. (granted, Redspot/Sixt seems to be cleaning up its act)

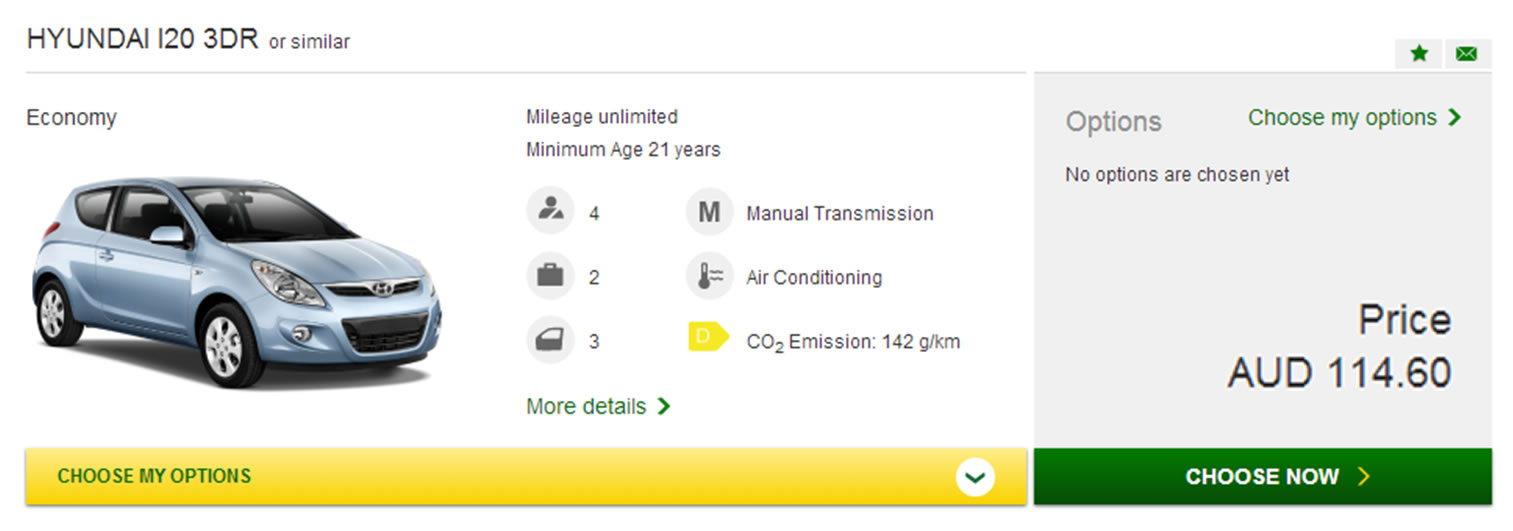

More Confusion with AVIS T&Cs

I once spent an hour emailing back and forth with the AVIS help desk, which was very prompt, I must say, but all I wanted to know was if a windscreen would be included in their $3300 excess for their standard liability. After 4 exchanges I was not really any clearer and to tell the truth I still could not tell you for sure if our excess insurance covers windscreen damage with AVIS.

[Des]

I am doing some research on what liability I have if I rent a car from Avis.

If i do not take out any additional cover for a small car what does your standard liability cover? ie are Windscreens, tyres and lights covered and what about single vehicle accidents?

[AVIS]

All our vehicles regardless of size come with automatic insurance – Loss Damage Waiver. Upon payment of the agreed excess which is usually $2650 plus taxes, you are covered for all damage to the vehicle as well as third party property, provided you have acted in accordance with the terms of rental. (copy attached)Things which are not covered are listed in section 8.3 as follows :

8.3 Additional amounts payable: In addition to Clause 8.2, You must always pay to Avis the following costs and fees:

(a) the cost of repairing any:(i) Overhead Damage or Underbody Damage;

(ii) water damage to the Vehicle;

(iii) damage to the Vehicle or to the property of any third party caused

by a breach of clause 3, 4.1 or 5;

(iv) damage to a tyre or an Accessory not attributable to normal wear and tear; and

(v) damage to the Vehicle or to the property of any third party caused deliberately or recklessly by You, any other driver of the Vehicle or any passenger carried during the Rental Period;

(b) the cost of replacing, if lost or stolen, an Accessory; and

(c) if You have breached the Rental Agreement, a per day loss of revenue

fee based on the actual and estimated downtime of the Vehicle.

[Des]

Hello again. Can I confirm that Overhead and Underbody damage means Windscreens and wheels and tyres etc?

[AVIS]

Please refer to the attached under the heading :

INTERPRETING YOUR RENTAL AGREEMENT

Overhead Damage’ means damage to the Vehicle or property of any third

party caused by the Vehicle coming into contact with anything above the top of the door seal and the top of the front and back windscreens; and

Underbody Damage’ means damage to the Vehicle caused by the Vehicle coming into contact with anything below the bottom of the door seal and the bottom of the front and rear bumper bars.

[Des]

Thanks again P for the info but I am sorry to be a pain but can you just tell me if the windscreen would be covered as part of your standard liability?

[AVIS]

The windscreen is covered provided you pay the agreed excess. So for example, if your agreed excess is $2650 and the new windscreen costs $165, you only pay $165.

My Conclusion

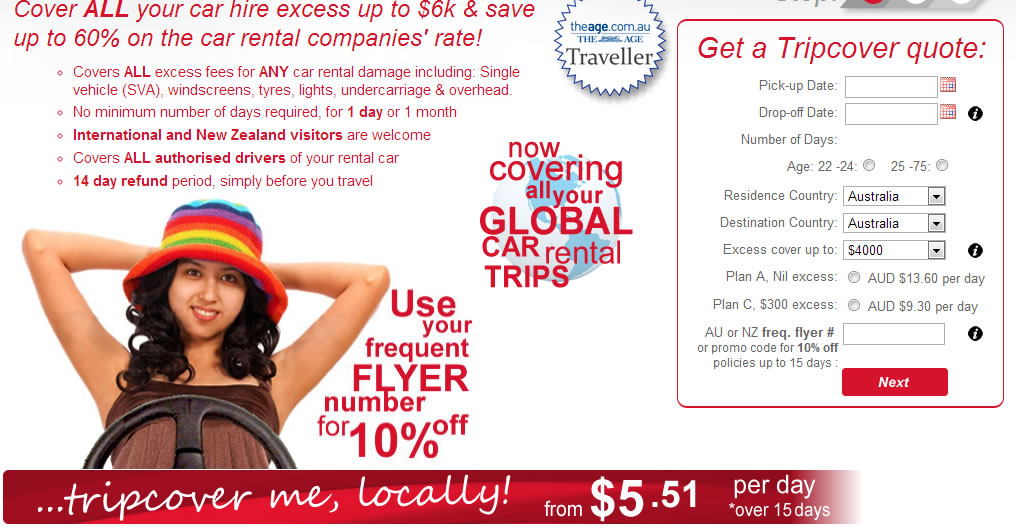

I think it is time for a change, time to help rental customers in Australia and New Zealand to get their head around their liability when hiring a car. I am hoping, with a little help from Allianz, Tripcover’s underwriter and Allianz Global Assistance, who we come under management from, we can come up with a NoButs plan that will take the confusion and uncertainty out of the car rental industry or at least reduce it.

Who said that Car Rental Excess Insurance can’t be sexy?