Maybe ANGER is a tool for observing a problem but not for fixing it!

Don’t let the car rental companies get you angry anymore fix the excess insurance problem using Tripcover!

Maybe ANGER is a tool for observing a problem but not for fixing it!

Don’t let the car rental companies get you angry anymore fix the excess insurance problem using Tripcover!

Email enquiry from one of our customers at Tripcover

Karl: “As I am in the process of taking out a policy, I’m somewhat puzzled by the fact that one of your competitors “I Cover” provides supposedly similar cover as yours but the cost is less than half. How can this be?

Furthermore their policy also covers a number of other benefits.

Thanking you.”

Tripcover’s Reply

“Hi Carl, but they cannot say and do not say that they cover windscreens, undercarriage, tyres, lights and single vehicle accidents in their PDS because they don’t generally as they only cover what the standardexcess or CDW that the car rental companies offer.

But it is a free market, you can buy travel insurance which is what they offer or you can buy our specialist car rental excess cover. Up to you.”

PS Karl’s reply was as follows:

“Many thanks.This would be a great brief for a PR campaign for Tripcover. For as a consumer, it can be very confusing out there.

My initial suspicion was based on the value for price/offering, which prompted me to investigate further, and the unclear answers I got back from them.

Thank you for getting back to me, so I can now take out a Tripcover policy, as well as passing on the information to family, friends and contacts.

Best wishes

Karl

The Checkout Australia reviews the car hire industry and suggests to use Tripcover to save on the car rental excess insurance.

JOSEY WROTE:

I am thinking about purchasing a rental vehicle excess insurance and have a question regarding the quotes on your website.

I see that the insurance you provide is from Allianz. I have asked Allianz for a quote and their premium is higher than yours for a 16 day rental:

$4000 AUD excess with Allianz costs $281 AUD and with you $135 AUD

$6000 AUD excess with Allianz costs $383 AUD and with you $295 AUD

Can you please help me understand why is there such a difference? Is the cover the same regardless of getting it through you or through the Allianz website?

Thank you.

MY REPLY WAS:

Exact same policy Josey, only you are paying a premium with Allianz and Hiccup (they are the system provider) as they are covering

21 to 75 year olds in the same policy.

We have split our policy up to:

25 to 75 and

21 to 24 year olds

So if you were 22 years old our’s would cost you around the same price as with Allianz

Rental car giant Hertz has been forced to refund hundreds of aggrieved customers amounts totalling $395,000 because it had charged them for damage they did not cause.

Following an Australian Competition and Consumer Commission investigation, Hertz admitted that between November 2013 and August last year it had incorrectly charged customers for causing damage to a rental car that was in fact pre-existing………..

>Read more: https://www.smh.com.au/business/consumer-affairs/hertz-to-refund-hundreds-of-customers-it-falsely-accused-of-damaging-rental-cars-20160405-gnymfe.html#ixzz450TGsl46

Follow us: @smh on Twitter | sydneymorningherald on Facebook

If you wanna travel around Australia on your own, then you should definitely consider self-driving around Tasmania. Tasmania is the smallest state of Australia far down in the South. Read on to find out why solo traveling around Tasmania is a good idea…..More>

If you wanna travel around Australia on your own, then you should definitely consider self-driving around Tasmania. Tasmania is the smallest state of Australia far down in the South. Read on to find out why solo traveling around Tasmania is a good idea…..More>

Hi folks, yes that’s right I am writing an article about our number one competitor as it enters our category and market place. Allianz.com.au, one of the world’s biggest insurance companies has now entered the car rental excess insurance market and is competing head to head with Tripcover’s car rental excess insurance products.

This is a great sign for us as a giant like Allianz, entering this category that my brother Steve and I created in Australia, verifies that this means business and our category is not likely to go away anytime soon.

And what is this category? Well, anyone that has ever rented a car will know what I am talking about. You know, you get to the car rental desk and they ask you if you want to take out their CDW or Collision Damage Waiver (it is basically their own insurance that

they manage themselves only they can’t call it insurance).

Now this CDW can cost as much as the rental car itself or even more, per day and so can double your rental costs. The car rental insurance policy that Tripcover sells is around $9 per day. Although the policy that Allianz sells is the exact same product, supplied by Allianz Global Assistance, they have a higher rate due to it covering 21 to 75 year olds. We have split our age range so that you can by our policy for either 25 to 75 year olds or 21 to 24 year olds and it is considerably cheaper.

About the Car Rental Excess Insurance Category

With present sales of around $10M in Australia and representing around 3% of the car rental insurance market, we estimate that the category will be worth some $38M by 2020 and represent around 8 to 10% of the car rental insurance market place, by then.

Car rental excess insurance has been going in Australia since the start of 2012, for over 4 years now and we see it becoming main stream by 2020.

Latest ProductReview from Brad one of Tripcover’s Customers

Hiring vehicles when driving in unfamiliar areas as well as being worried about even slight damage such as carpark door dents, bumper / undercarriage damage & windscreens, is always a concern. However, Tripcover gave us peace of mind. Beforehand I had a query re the policy’s T & C’s & Des personally responded within a day.

Great service at a fraction of the car rental company’s excess reduction (which also does not cover the extent of damage that is covered by the Tripcover policy). And it’s backed by Allianz should a claim be made. We look forward to using your rental vehicle insurance service again in the future.

According to the authors of:

First Break All the Rules:What the World’s Greatest Managers Do Differently

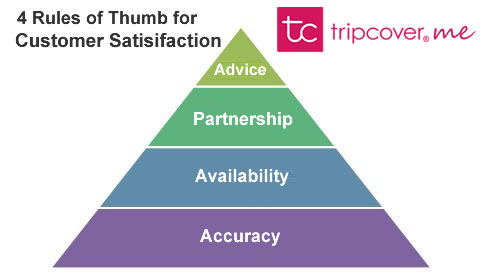

the 4 rules of thumbs for customer satisfaction on P128, the first 2 rules are not going to get you any more than satisfied customers, that is having Accuracy and Availability.

But if you really want to get your converts and advocates for your company you are going to need the last 2 rules of thumb which are Partnership and Advice.

“Partnership and advice are the most advanced levels of customer expectation. If you consistently meet these expectations, you will have successfully transformed prospects into advocates”

Over the last 4 years there has been the sprouting of a new category in Australia in the car insurance – car rental industry, that of car rental excess insurance.

Initiated by Des and Steve Sherlock of Tripcover, at the start of 2012, it now includes some 5 players in the Australian market. They inlcude:

This category has the potential to eat into the large profits that the car rental companies have been enjoying for decades. What is different about this category is that unlike using

travel insurance or credit cards to hope you are covered for what you think you should be covered for, this car rental excess insurance is designed specifically for competing head to head with the car rental companies.

The main difference between the insurance product and the car rental companys’ product, is that in the event of an accident you would need to claim with the insurers such as Allianz Global Assistance, QBE, whereas if you use the more expensive car rental companies waiver (CDW) they handle any damage issues.

And by expensive we mean very expensive. The car rental companies waiver can cost as much if not more than the rental per day with the car rental excess insurance supplied by Tripcover coming in as low as $5.60 per day.

The category has seen amazing growth over the last 4 years with estimates that some

$12M in sales in the last financial year, from these companies. This represents about 200,000 policies sold out of 6.5M rentals in Australia per year or around of 3% of the market so far.

It is predicted that by 2020 the car rental excess insurance market in Australia will be 10% of the car rental market, worth $38M.