When renting a car in Australia or New Zealand, it is very important to have quality car rental excess insurance coverage for the vehicle. You have several options available, and by comparing and contrasting the different types of insurance, you can have a better idea of what you might need.

Credit Card

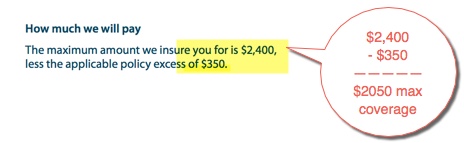

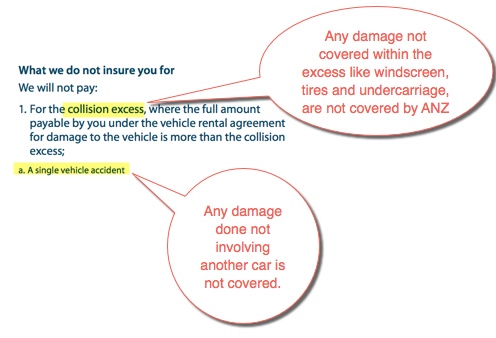

Many times, the credit cards you already have in your wallet will actually have collision coverage included on them. If you choose the right credit card to pay for the rental, you could actually receive coverage with zero deductible, or at least a very low deductible. This is quite different from the high cost of insurance through the car rental companies. The right card has the potential to provide coverage for the costs for which you might be liable, such as damage to the car, or even a theft but a lot of times does not cover the general exclusions such as windscreen, tyres, single vehicle accidents or undercarriage damage.

Another issue is that some that use this method of coverage for their rental vehicles have is that it can be a hassle to deal with the credit card companies. Still, given the amount that you could possibly save in the event of an accident, it does make sense at least to consider utilizing credit card coverage for the rental.

Make sure that your credit card company offers this type of coverage, as some do and some do not. Look through the policies regarding the coverage it offers, and make sure it is applicable in Australia or New Zealand – or any country you might be visiting for that matter.

Standard Travel Insurance

In some cases, you may also have collision coverage available through your travel company. If you buy a travel insurance policy for your vacation through many companies in Australia and New Zealand, you will have the option of adding on insurance for your car rentals. However, it is important to make sure that the travel insurance policy that you are considering using actually cover all the normal exclusions that the car rental companies exclude, such as windscreens and single vehicle accidents.

Dedicated Car Rental Excess Insurance

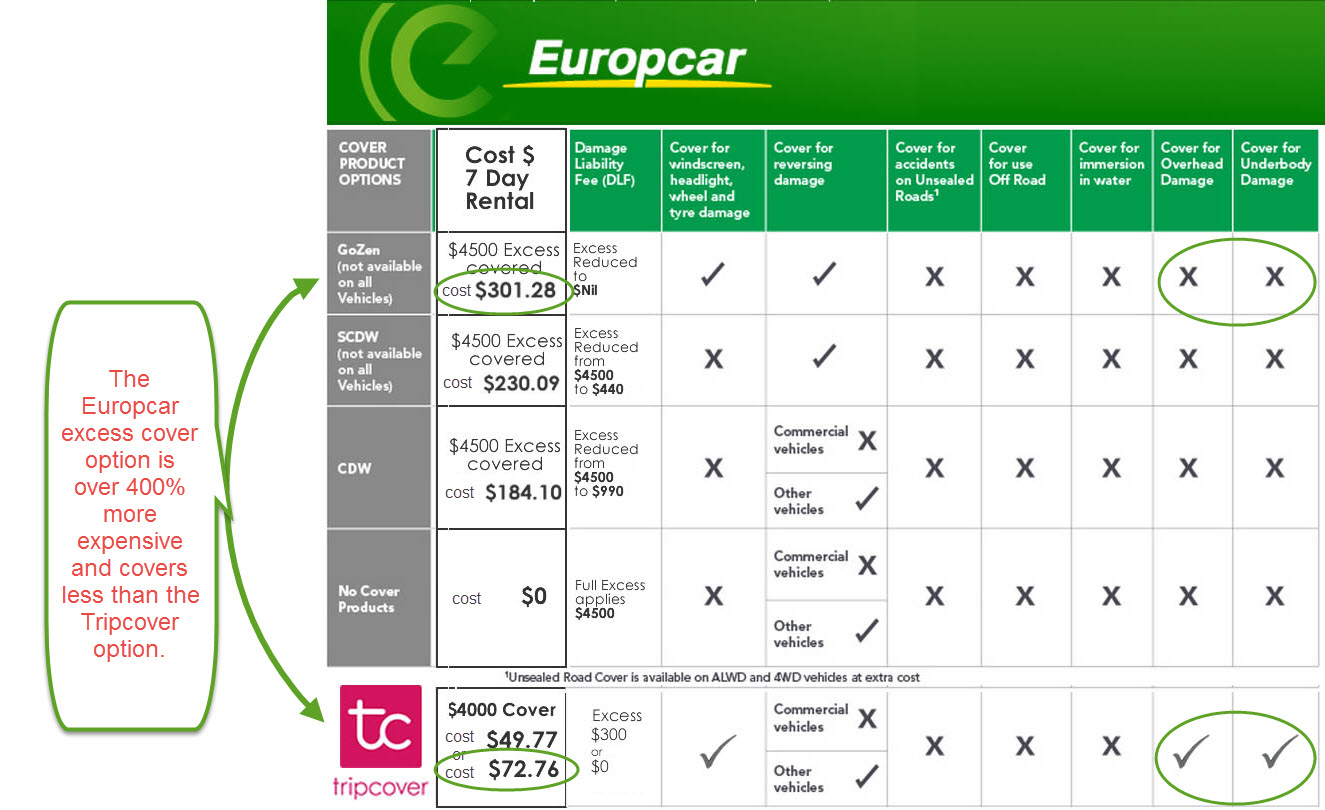

Of course, there’s always the option of buying your car rental excess cover (usually called CDW or Collision Damage Waiver) from the car rental company. This is something they will actually encourage you to do. It’s a simple solution since you can do it right at the counter. However, that does not necessarily mean it is the best solution. The cost of the insurance through the company is expensive, and could be close to the cost of the rental itself, which could double your overall expenditure. When you buy insurance through the rental company, you should not think that it will automatically cover the entire cost of damage or theft. Look at what your excess or deductible will be. It can be in the thousands in many cases. Car rental companies will sometimes offer an additional form of coverage that will drop the deductible to zero. Of course, this adds to the cost of your rental substantially.

Dedicated car rental excess cover is also offered now by such companies as Tripcover and this can be less than half the cost of the car rental companies’ rates.

However there is also the hassle of making a claim with their insurance provider Allianz Global Assistance in the event of an accident.

Take the time to research all of your options for your car rental insurance, and then choose the one that makes the best financial sense for you.

Resources:

https://www.ricksteves.com/travel-tips/transportation/car-rental-cdw

http://www.tripadvisor.com.au/ShowTopic-g255103-i531-k5982489-Car_rental_excess_reduction_Tripcover-Perth_Greater_Perth_Western_Australia.html